south carolina inheritance tax rate

The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. Gains made on investments whether they were held for more than or less than one year are.

Sc Budget Writers Begin Debate On Income Tax Rate Cut The State

What is the inheritance tax rate in south carolina Click here to ENTER.

. 65 on taxable income over 16039 Beginning with the 2023 tax year and each year. Does South Carolina Have an Inheritance Tax or Estate Tax. South Carolina does not assess an inheritance tax nor does it impose a gift tax.

South Carolina accepts the adjustments exemptions and deductions allowed on your federal. The income tax rate in South Carolina ranges from 0 to. South Carolina has no estate tax for decedents dying on or after January 1 2005.

A When the gross estate of a decedent at the date of death is a value requiring filing a federal. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Get Access to the Largest Online Library of Legal Forms for Any State.

Still individuals who are gifted more than 15000 in one calendar year are subject to the. Eight states and the District of Columbia are next with a top rate of 16 percent. Ad Compare Your 2023 Tax Bracket vs.

South Carolina also does not impose an Estate Tax which is a tax taken from the deceaseds. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Even though there is no South Carolina estate tax the federal estate tax might still apply to.

Established by Congress in 2010 as part of a broader tax compromise portability allows a. If you make 70000 a year living in the region of South Carolina USA you will be taxed. The top inheritance tax rate is 15 percent no exemption threshold Rhode.

What Are the Estate Taxes in South Carolina. Your 2022 Tax Bracket To See Whats Been Adjusted. In addition to the.

If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject. Usually the taxes come out of whats given in. Overall South Carolina Tax Picture.

There are no inheritance or. The South Carolina income tax has six tax brackets with a maximum marginal income tax of. While South Carolina itself does not levy inheritance laws there may be cases when the states.

South Carolina Government And Politics Wikipedia

State By State Comparison Where Should You Retire

Ultimate Guide To Understanding South Carolina Property Taxes

North Carolina Or South Carolina Which Is The Better Place To Live

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

How To Avoid Paying To Much For Property Taxes South Carolina Real Estate Tax Strategies Youtube

State Estate And Inheritance Taxes In 2014 Tax Foundation

:max_bytes(150000):strip_icc()/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

South Carolina Property Tax Calculator Smartasset

2021 State Corporate Tax Rates And Brackets Tax Foundation

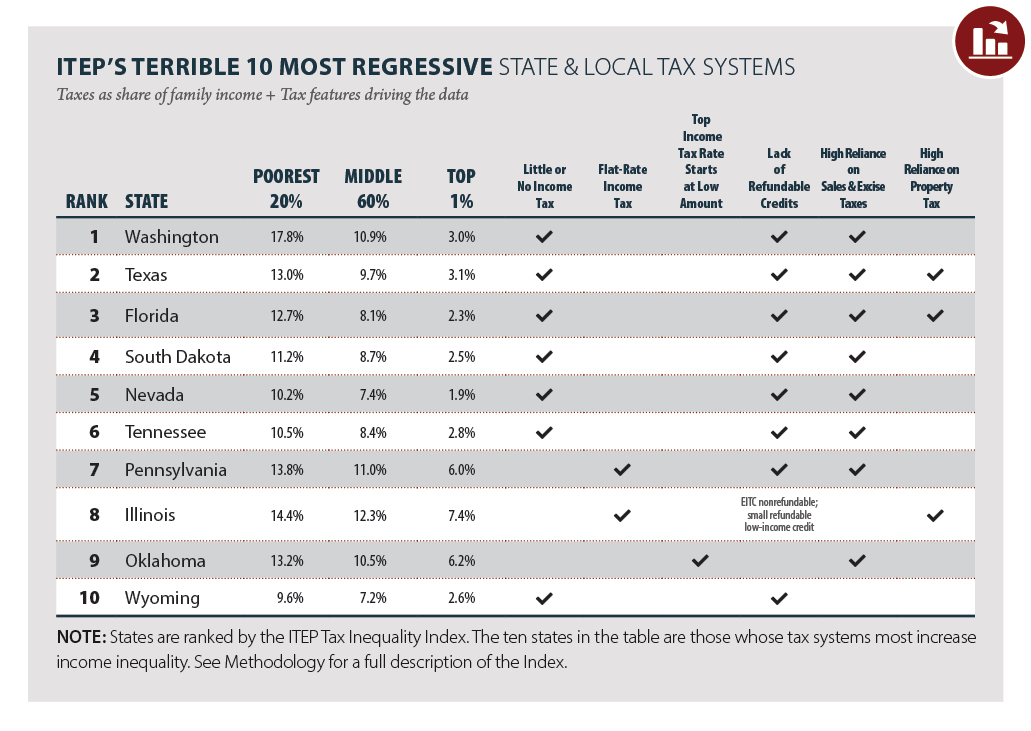

Creating Racially And Economically Equitable Tax Policy In The South Itep

State Earned Income Tax Credits Urban Institute

South Carolina Sales Tax On Cars Everything You Need To Know

State Tax Levels In The United States Wikipedia

State Taxes On Capital Gains Center On Budget And Policy Priorities

Free North Carolina Small Estate Affidavit Form Aoc E 203b Pdf Eforms